Novated Leasing for Praslas Australia

Take advantage of tax savings and convenience with a tailored novated lease plan.

Flexible Payment Options

Simplified Vehicle Management

Significant Tax Benefits

We specialise in helping employees secure competitive novated lease packages, regardless of whether your organisation already offers salary packaging options.

What is a Novated Lease?

A novated lease is an agreement where your employer pays for your vehicle expenses from your pre-tax salary.

✅ Reduces your taxable income, saving you money.

✅ Bundles all car expenses (fuel, insurance, servicing) into one easy payment.

✅ Gives you the flexibility to choose new or used vehicles.

How We Help Praslas Australia Employees Get the Best Novated Lease

Retention

By offering a novated lease, we provide employees with a valuable benefit that encourages long-term commitment and satisfaction.

Reward

A novated lease is a great way to reward employees for their hard work, offering access to vehicles at a lower cost while saving on taxes.

Employee Benefits

Employees enjoy a range of benefits, including reduced taxable income, streamlined payments covering all vehicle expenses, and significant savings on running costs. Novated leases are tax-effective, making them an attractive perk that adds real value.

Car Purchase

We simplify the vehicle purchasing process by working with trusted dealers, ensuring Pralas Australia employees get the best deals on new or used cars without the usual stress.

Cost Effectiveness

Novated leases help employees lower their car-related expenses while freeing up their take-home pay. By bundling fuel, servicing, and insurance into one pre-tax payment, Pralas Australia employees benefit from a seamless, cost-effective solution.

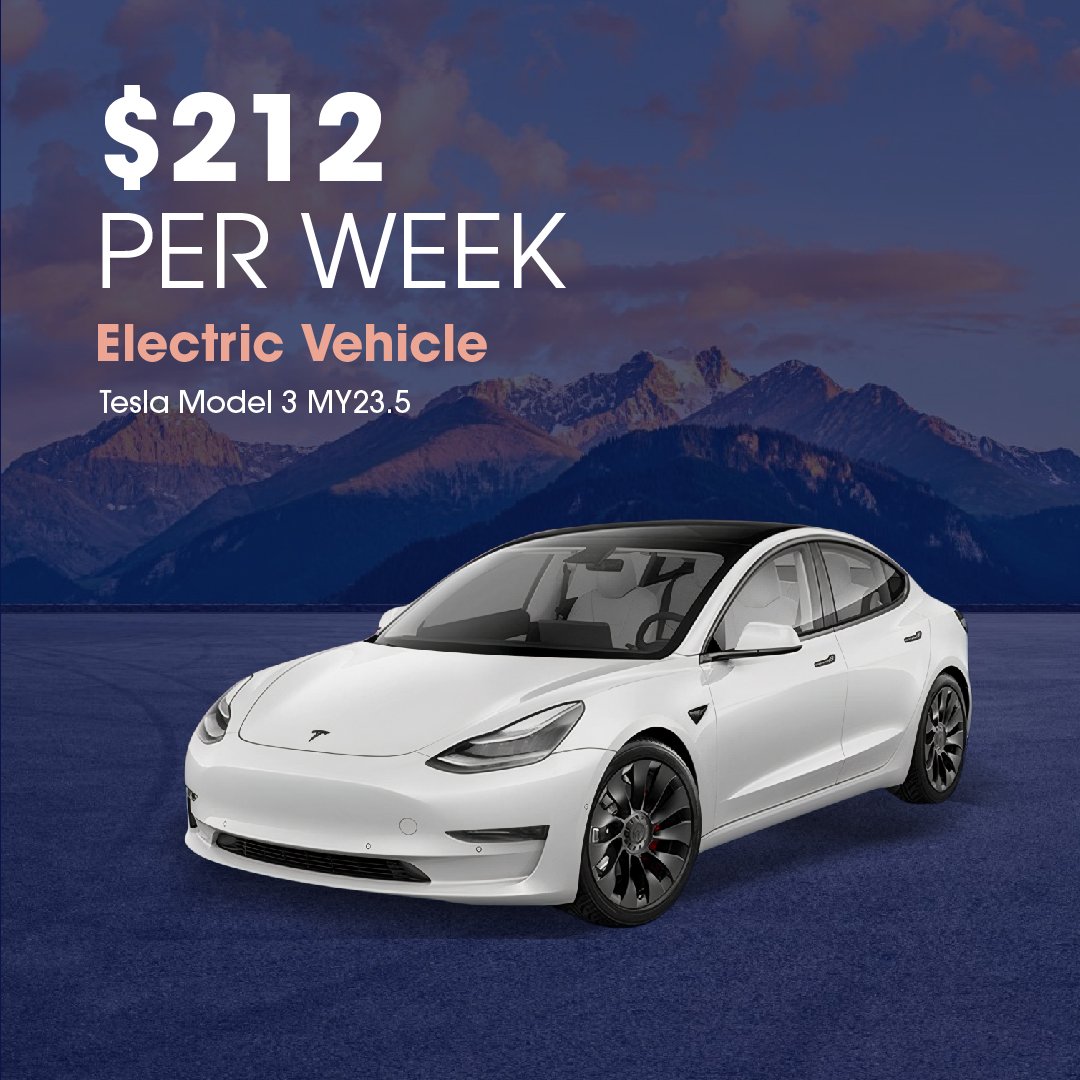

Deals You Can’t Beat

Discover unbeatable novated lease offers that combine value and flexibility.

Exclusive Discounts: Get access to discounts on new vehicles.

Wide Range of Vehicle Options

Choose from a vast selection of vehicles, whether you're interested in a brand-new car or a used one.Tax-Effective Savings

Enjoy the financial advantages of paying for your vehicle and running costs from your pre-tax salary, reducing your overall taxable income.

How to Set Up Novated Leasing

We work with Australian government employees, whether you're in the justice department at the federal or state/territory level. We can:

1

Select Your Vehicle: Choose the perfect car that fits your needs from our available range.

2

Submit a Fast Form Fill out our quick form, and we'll set up a call to begin the process.

3

Credit Approval and Lease Agreement Complete our credit application. Once approved, sign the lease documentation to proceed.

4

Employer Coordination We'll send onboarding information to your employer, guide them through the process, and they will sign the deed of activation.

5

Vehicle Delivery Once the finance is settled, your new vehicle will be delivered to you.

6

Payroll Arrangement We will provide payroll advice to your department or payroll provider (e.g., Xero) to ensure smooth payment arrangements.

How to Set Up Novated Leasing

We work with Australian government employees, whether you're in the justice department at the federal or state/territory level. We can:

Select Your Vehicle: Choose the perfect car that fits your needs from our available range.

2

3

Fast Form Submission: Fill out our quick form, and we’ll schedule a call to guide you through the process.

4

Credit Application: Complete your application, and after approval, sign the lease agreement to proceed.

5

Employer Coordination: We will liaise with your employer, provide onboarding details, and finalise the deed of activation.

6

Delivery: Upon finance approval, your new car will be delivered to you.

Payroll Setup: We issue payroll advice to your department or supplier to streamline payments.

1

Get the best deal on a novated lease

Check Out Our Monthly Specials

Pick Any Car & We Will Deliver It